Evaluation is a very important concept in economics. It is what you need to do when you have finished analysing. By analysing we mean giving your Definitions, Explanations, Examples and Diagrams (DEED). Show how the theories relate to the question and explain the theories. Basically analysing is drawing out the theory and then evaluation is discussing the benefits and drawbacks and then drawing your conclusions and also challenging the analysis.

The hard part about all of this is making sure that you say enough in your analysis and in your evaluation. So you don’t forget, remember to “Do the DEED” when you analyze and then “CLASPP it all together” when you’re evaluating.

On your essay questions and data response questions (usually the last question) you’ll need to evaluate.

CLASPP

(d.) – A clasp is something that holds things together. But (spelled with 2 P’s) it’s also an acronym for the 6 types of evaluation in A Level Economics.

Use at least 3 of these in your Part B questions. Personally, I recommend to my students that they try use Stakeholders, Assumptions each time and include a third one of their choice. We always care a lot about stakeholder effects and assumptions is impressive because it shows that you really understand the theory.

Conclusions

-What can we conclude from the theory (that you’ve explained in your analysis)?

Long-term and short-term effects

-Is the change good in the short-term, but over in a few years it will have undesirable consequences?

-Will the policy be really hard on people in the short-run, but it fixes the long-term problem?

-Will this policy fix one problem, but create another?

-Will the policy be really hard on people in the short-run, but it fixes the long-term problem?

-Will this policy fix one problem, but create another?

Assumptions

-Are there some assumptions being made, that the theory depends on that may not hold true? This is the same as “ceteris paribus” –the assumption that all other things are being held equal, when in fact they might not stay constant. Explain what might change and how that would affect your analysis.

-Tell us the weaknesses in the theory?

-What is unrealistic about the theory?

-Tell us the weaknesses in the theory?

-What is unrealistic about the theory?

Stakeholders

-What effects would this policy (i.e. an indirect tax) have on the government, consumers, producers and the rest of society?

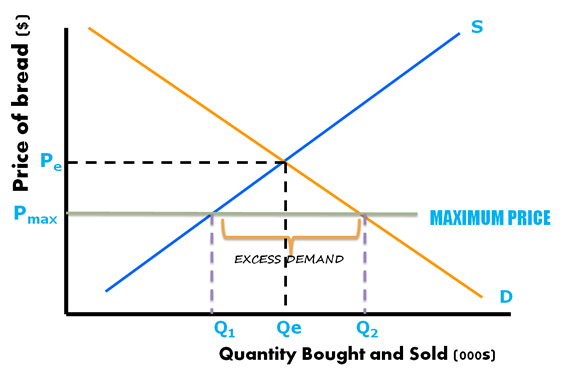

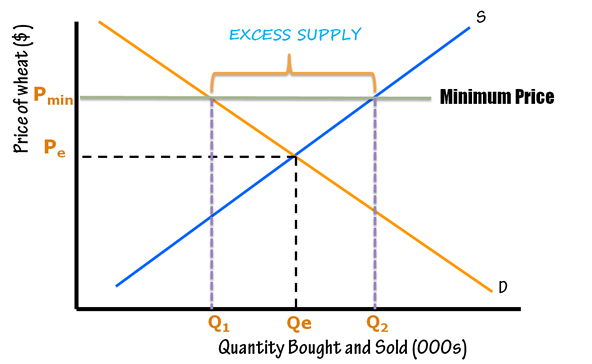

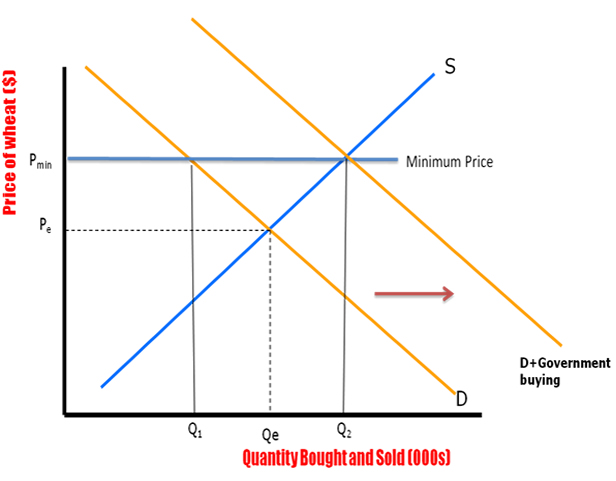

-Policies (i.e. price ceilings) are often made with particular stakeholders in mind, so are there undesirable effects on other parties (i.e. price increases for consumers)?

-Is the policy great for some groups, but bad for others?

-Policies (i.e. price ceilings) are often made with particular stakeholders in mind, so are there undesirable effects on other parties (i.e. price increases for consumers)?

-Is the policy great for some groups, but bad for others?

Priorities

-Discussing the priorities of a society, or the government is also a good way to keep things in perspective. A policy like subsidising schools is good for families, good for the long-term macro economy, but bad for tax payers who don’t have children, what are the priorities as a society?

-Is there an important normative (i.e. values aspect) that the theory doesn’t consider?

-Is there an important normative (i.e. values aspect) that the theory doesn’t consider?

Pros and Cons

-What are the advantages and disadvantages of this policy?

-What are the costs and the benefits of this policy?

-What are the arguments for and the arguments against this policy?

-This one is to double-check that you haven’t left anything out in the preceding ones.

-What are the costs and the benefits of this policy?

-What are the arguments for and the arguments against this policy?

-This one is to double-check that you haven’t left anything out in the preceding ones.

Credit to Mr. Tim Woods

www.timwoods.org